Blogs

Homebuyers within the New york is generally eligible for assistance with down payments and settlement costs in one of a few statewide firms. State Earliest offers a rural step to own home buyers inside underserved section. It offers around 8,five-hundred inside forgivable advance payment direction alongside special fixed-speed investment for both basic-time and flow-up borrowers, with choices for FHA, conventional, USDA, otherwise Virtual assistant financing. The new Puerto Rico Property Fund Expert (PRHFA) program are an important funding for low and you can modest-money homebuyers inside Puerto Rico.

Cannot believe any grant honor notification which comes of social networking networks such as Facebook otherwise Instagram. Do not send any money to anyone due to a funds application or cable or any style from currency to get a good offer. Of trying to verify the brand new authenticity of an offer, it is vital to adopt that is offering the grant. Is it a federal government give via a national, condition otherwise regional department? If the investment supply is not familiar, spend time researching these to verify that the brand new organization try reliable. You should get the organization on the Internal revenue service website using the fresh ‘lookup from the company term’ solution.

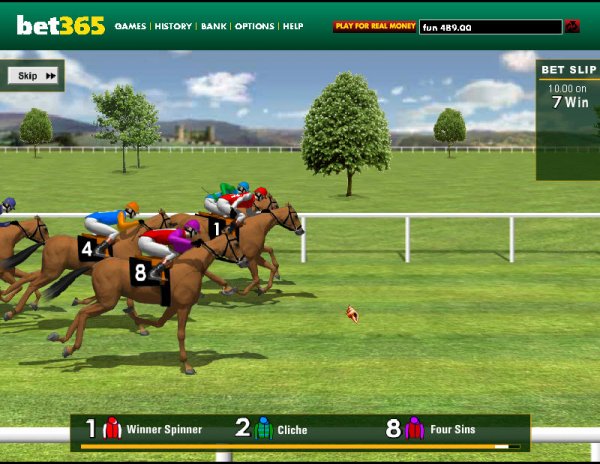

The amount of paylines try ten, but it is around the new punter that they need to to activate. Punters perform earn the overall game when comparable signs line-up together with her on the paylines. Because of the activating all the paylines, the newest bettors expands the odds of profitable. You can discovered a deposit financing of up to 4percent of one’s total financial number when along with property Advantage first mortgage. The amount increases to 5percent to own a conventional HFA Popular financing.

That it grant can be applied so you can down payments, settlement costs, home loan rates buydowns, or pre-paid back mortgage insurance policies. A dedicated program for very first-generation homebuyers within the discover metropolitan areas giving an excellent 25,100000 forgivable loan for Costa Games live-casino usage to possess a down payment and you will closing costs. This really is a no-focus financing without monthly payments that’s forgiven once five many years. Access to a medication financial and you will end from an excellent homebuyer training path are also criteria of the system. The fresh IHD Accessibility Forgivable system also offers a forgivable loan to help on the downpayment and you can closing costs.

Report Bodies Grant Cons | Costa Games live-casino

Offers is free and provided to you or your online business based on the merit and you will qualifications. If someone orders you to pay a little fee for a good guaranteed huge give size (award), this can be never ever a legitimate offer. Do not mistake it having spending money on a give-list services including GrantWatch.com, where you spend a subscription percentage to gain access to a complete directory.

Give Programs

Their real estate agent otherwise financing officer may also have suggestions to possess regional offer apps. Start by contrasting various homeownership applications supplied by regional otherwise county housing authorities. These types of programs usually are first-date house buyer offers and low-desire money.

- So it low-repayable grant are flexible, making it possible for receiver to use the amount of money beyond just down repayments and you can settlement costs.

- You’ll find qualification assistance and you may assets conditions on the program’s on the web pamphlet.

- Typical conditions is becoming an initial-time home client, a good credit rating, and you can lower so you can modest earnings, whether or not particular laws and regulations are very different.

This choice offers the advantageous asset of allowing you to become a good citizen with reduced initial costs. You could potentially repay the borrowed funds from the a later stage should your financial predicament might possibly be much warmer. The newest DHCD also provides very first-date home buyers which have reduced to help you moderate profits advice about their advance payment and settlement costs with the Home Buy Assistance Program, known as HPAP. The fresh Texas Homes and you will Money Expert will bring beneficial assistance to earliest-day homebuyers in the form of down payment direction gives and next mortgage loans. These types of applications allow it to be easier for Texas homes that have modest and lowest income to buy property. Even if you might have fun with the finest game from these designers for free or not, depends mostly for the incentives provided with the internet gambling enterprises you play with.

While you are a recent scholar, OHFA offers a 2.5percent or 5percent assistance mortgage to cover the downpayment and closing costs. So it financing is forgiven after five years if you don’t refinance, move, or offer your property. The application has lots of options and you will laws and regulations, very review the main points on the internet site.

The newest Agency from Experts Issues backs the new Virtual assistant home loan, offered to customers since the repaired- or adjustable-price mortgages throughout fifty says. System qualifications means a good 620 credit score, a fiftypercent debt-to-money proportion, and you may buyers need meet up with the definition of a first-time family client. Conventional 97 are a 3-percent off antique home loan for home buyers who aren’t low- and you will average-earnings earners. The application is often known as Simple 97 LTV, that is shorthand to possess a good “simple antique 97percent loan-to-well worth home loan”. House You can means eligible consumers for a good 660 credit history while you are enabling around 50percent DTI.

Added bonus Provides GrandX Casino slot games

Assist a home loan team pre-agree your mortgage and give you information. Mortgage banks and you will agents wear’t topic mortgages with deferred home loan repayments. Where you can come across a deferred home loan is with a good municipal government otherwise local foundation, that may matter deferred mortgages inside the amounts up to twenty five,one hundred thousand. Bucks has try non-repayable gifts so you can earliest-time homebuyers to aid pick its very first household. HomeReady is a great 3-per cent advance payment mortgage that gives smaller financial cost and lower mortgage charges for lowest- and you will reasonable-earnings homebuyers. First-date customer apps develop homeownership opportunities to the newest customers.

Pros DPA

GrandX Gambling establishment try belonging to Alpache OÜ and contains estimated revenues surpassing step one,100000,000 a-year. That it set it as a small so you can medium-sized on-line casino within the bounds in our categorization. Thus far, i have obtained only six athlete reviews of GrandX Casino, for this reason which local casino does not have a user satisfaction get but really. The brand new score are computed on condition that a casino features gathered 15 or even more recommendations. The reviews submitted from the users appear in the brand new ‘User reviews’ part of the webpage. A deck intended to program our efforts aimed at taking the sight out of a better and much more clear gambling on line industry to fact.